The Punjab government’s Karobar Card Loan Scheme is an excellent effort for small and medium-sized enterprises. Offering interest-free loans makes it simpler for business owners to launch or expand their enterprises without worrying about money. However, during the application process, many candidates commit typical errors that might cause a clearance to be delayed or even denied. We’ll review these errors in this post and how to steer clear of them for a successful loan application.

| Feature | Details |

| Loan Amount | PKR 100,000 to PKR 15 Lakhs |

| Interest Rate | 0% (Interest-Free) |

| Repayment Period | Up to 7 years |

| Target Audience | Small and Medium Businesses |

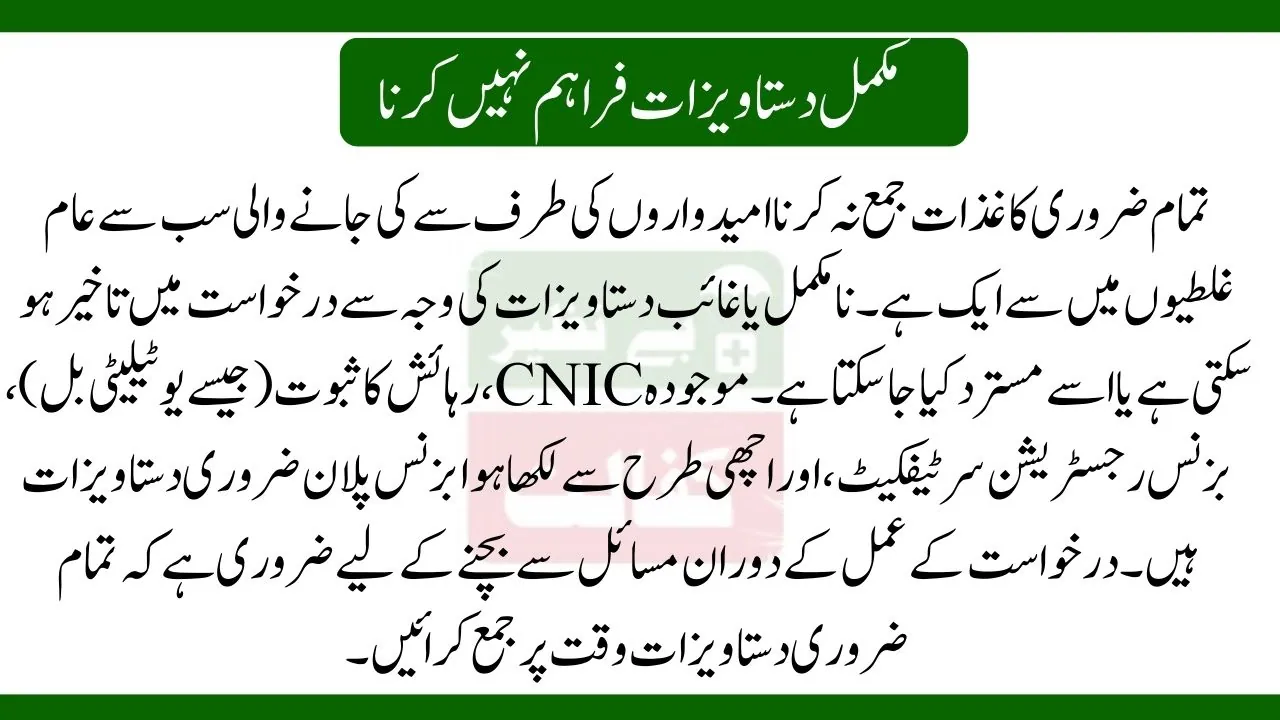

Not Providing Complete Documentation

Not submitting all the necessary paperwork is one of the most common errors made by candidates. Incomplete or missing documentation may cause the application to be delayed or may be rejected. A current CNIC, proof of residency (such as a utility bill), a business registration certificate, and a well-written business plan are essential documents. To prevent problems during the application process, it is essential to submit all required documents on time.

Key Documents to Submit:

- CNIC for identification.

- Proof of residence to verify location.

- Business registration to confirm legitimacy.

- Business plan to explain loan utilization.

Ignoring Eligibility Criteria

There are some qualifying conditions for the Karobar Card Loan, and failure to meet them may result in denial. For instance, candidates must reside in Punjab, be between the ages of 18 and 55, and operate a registered business. Applicants should make sure they meet these requirements before applying, as startups and technology-based firms are given preference. It is easier to avoid wasting time and effort on applications that are not qualified when one is aware of the eligibility requirements.

Eligibility Highlights:

- Age: 18-55 years.

- Residency: Punjab domicile required.

- Business: Must be registered and operational.

Failing to Prepare a Solid Business Plan

Having a well-defined and comprehensive business strategy is essential to getting the Karobar Card Loan. Many applicants don’t specify how they intend to use the loan, how it will help the firm, or how they would pay it back. Specific objectives, information on loan utilization, and possible financial gains like employment creation are all included in a strong business plan. Without a clear plan, lending authorities can view the application as dangerous.

Tips for a Strong Business Plan:

- Clearly state the purpose of the loan.

- Explain how the loan will grow your business.

- Include a repayment strategy aligned with business goals.

Misunderstanding the Loan Terms

Some applicants don’t fully comprehend the Karobar Card Loan’s terms and restrictions. Despite having no interest, the loan has a maximum seven-year repayment duration. Planning repayments following the company’s financial capabilities is crucial. Later financial stress may result from misinterpreting loan terms. Always read the terms and make sure you understand them or ask for clarification if necessary.

Applying for an Amount Beyond Your Needs

Applying for a loan over what the company truly needs is another typical error. Even though the program provides loans ranging from PKR 100,000 to PKR 15 lakhs, taking out more debt than is necessary raises repayment requirements. Candidates should evaluate their business needs and only submit applications for funding that fits their budget. Financial difficulties and needless debt can arise from overborrowing.

Overlooking the Importance of Timely Repayments

Some business owners neglect to make timely loan repayments a priority after obtaining one. Penalties and damage to the applicant’s credit history may result from late payments. Since the Karobar Card Loan has adjustable periods of repayment, it’s critical to design a repayment plan that works with the cash flow of the company. In addition to preserving financial stability, on-time repayments improve the likelihood of obtaining additional loans.

Conclusion

An excellent way for business owners to expand their enterprises without having to worry about paying interest is through the Karobar Card Loan Scheme. However, the secret to maximizing this campaign is to steer clear of typical blunders. Applicants can increase their chances of acceptance by satisfying eligibility requirements, providing all necessary paperwork, creating a strong business plan, and being aware of the terms of the loan. Businesses will achieve long-term success and financial stability with careful planning and on-time repayments.

Also Read: Essential Documents Needed for Karobar Card Loan Application

FAQs

1. Can I apply if my business is not registered yet?

No, only registered businesses are eligible for the Karobar Card Loan. Ensure your business is properly registered before applying.

2. How can I ensure my business plan is strong enough?

Include clear goals, loan utilization details, and a repayment strategy in your business plan to make it convincing and reliable.

3. What happens if I miss a repayment?

Missing repayments can lead to penalties and harm your credit history. Plan your repayments carefully to avoid financial issues.

4. Can startups apply for the Karobar Card Loan?

Yes, startups, especially technology-based ones, are eligible and given priority under the scheme.